Developed by Bains and Company in 2003, the net promoter score or NPS® is used by countless businesses to measure their customers’ loyalty to them. Let’s first take a look at what NPS is about and how it is derived before discussing how to use it well.

A brief pretext

If you plan on making your business thrive for the long term, then you need to know how your customers feel about your company and your offerings on a regular basis. This is best achieved with surveys, but people usually dislike having to answer more than 10 questions. Therefore, it’s good to be able to measure critical metrics such as customer perception with one easy-to-answer question:

“How likely is it that you would recommend (Company X/Product Y/Service Z] to a friend or colleague?”

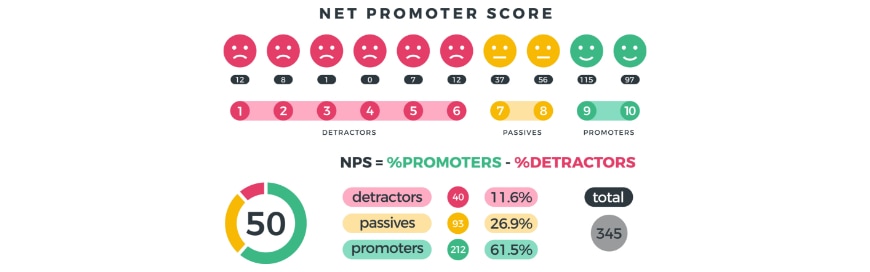

In a customer experience survey, respondents answer the question above by giving the mentioned item a score between 0 (not at all likely) and 10 (extremely likely). They will then fall into 1 of 3 categories based on the rating they provide.

| Category | Rating provided | Meaning |

| Detractors | 0–6 | Detractors are highly unlikely to become customers again, and may even post bad reviews and convince others not to do business with you. |

| Passives | 7–8 | Passives are satisfied with your product or service, but find nothing to rave about. |

| Promoters | 9–10 | Promoters love to keep supporting your business and will often go out of their way to refer you to others. Not only do they keep paying you, but they also help grow your business. |

Deriving your NPS

Once you’ve tallied the survey results, get the percentage of Promoters and subtract from it the percentage of Detractors. The difference will be your net promoter score (NPS).

To illustrate, let’s say that among the respondents for your survey about your new shampoo, the percentages for Detractors, Passives, and Promoters are 70%, 20%, and 10%, respectively. Therefore, your NPS would be 10-70 = -60.

NPS survey types

The NPS question is great for setting benchmarks, and sending NPS surveys to customers quarterly or annually is like taking a pulse to see if customer perception improves or declines over time. Such surveys are called relational because they indicate your customers’ overall relationship with your product (e.g., shampoo), service, or organization.

Transactional NPS surveys, on the other hand, are deployed right after a customer makes a significant interaction with your business, like making a purchase or chatting with a customer support agent. Such surveys allow you to measure customer satisfaction for nearly anything in particular — be it a dining experience, an electrical appliance, or a roofing contractor — as opposed to granting a view of the big picture the way relational surveys do.

Both types of surveys can help you understand your customers better and see if your business strategies improve customer sentiment or not. Obviously, having brand ambassadors is better than having mere customers, and much better than having ex-customers who are vocal about their dissatisfaction with you.

Learning what’s driving your NPS

Knowing how you got your NPS in the first place can allow you to change tactics and improve customer experience. With this in mind, here are what you need to consider adding in your NPS surveys:

Demographic questions

Surveys often begin by asking about age, gender, and level of income to help create segments and see if they exhibit significant trends. That is, what satisfies one particular age group, gender, or income class may be different from what satisfies another segment.

Only include demographic questions if you don’t yet have the data in your customer database.

Reason for the score provided

Right after your net promoter score question, you may ask the respondent why they gave the rating that they did. This open text question often leads to insights as to why one becomes a Promoter or a Detractor.

Reading every response can become time-consuming, so you may want to use a text analysis tool to parse the answers for you. Thanks to machine learning and natural language processing, such tools can identify frequently mentioned topics (e.g., product size, technical support) and changes in customers’ sentiments regarding those topics.

Suggestion to improve their experience

Asking the respondent how you can make their experience better is an excellent way to begin resolving the issues your customers may have with your offerings or your company as a whole.

Sometimes, respondents' additional comments may indicate ways on how to improve customer experience. For instance, if a customer gives a low rating because “the food we ordered arrived at our table cold,” a way to improve the experience could be to “serve the food warm and freshly cooked.” In other words, in certain cases, you may not need to ask for suggestions anymore.

Keeping track of it all

You can have staff manually keep tabs on customer perception and determine which touchpoints keep customers loyal and which touchpoints make them jump ship. However, scaling efforts as your respondent size grows will make manual tracking impractical and downright impossible. To do this, you need to leverage customer experience management platforms or other similar software. Ask your local IT service providers or IT vendors for their recommendations.

For software solutions that best fulfill the needs of your business, talk to our IT experts at Safebit Solutions. Leave us a message today.